what is an IVA?

An IVA is a formal debt solution aimed at people who owe more than £6,000 and who can afford to make a minimum single monthly payment towards all of the debts included in the IVA. Payments usually continue for a period of 5 years, after which time all remaining unsecured debts that were included in your IVA are written off along with accrued interest and charges.

As with any debt solution, it is important to that you seek professional advice before you enter into an IVA. Contact us today for the advice that you need.

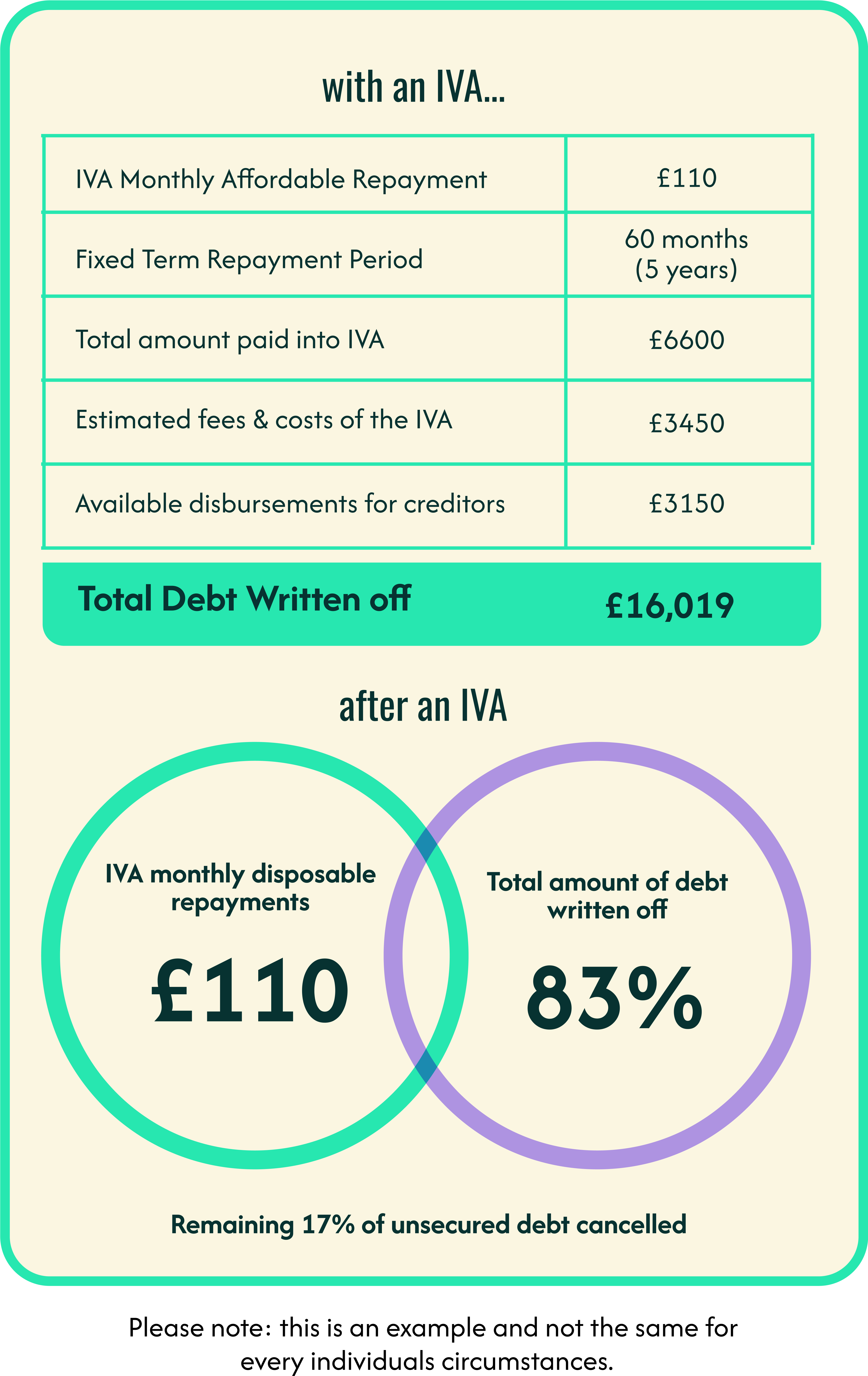

here's an example of how we can help you

Everyones debt is unique so this is just an example IVA solution but it’ll give you an idea of how it works.

single manageable monthly payments

A single monthly repayment towards all of your debts based on what you can afford.

write off what you can’t afford

Potential debt write off.

you won’t have to deal with creditors

Once your IVA is approved, creditors can not take further action to recover the debt.

no more spiralling charges

Interest and charges are suspended when your IVA is accepted.

no additional fees

The fees charged are taken from the affordable monthly payment you make over the agreed term of the IVA.

debt freedom

The remaining debt included within the IVA is written off at the end of the arrangement (add) provided you have made all your agrred payments.

potential increase in payments

If your circumstances improve during the IVA, increased payments may be requested.

public register

An IVA is a formal insolvency process and a record of this is held on the insolvency register which is a public register held on the internet.

must maintain payments

Failure to comply with the terms of the IVA may lead to the IVA being terminated which means creditors can then pursue you for any unpaid debts including those in the IVA.

loss of assets

Any assets that you acquire before the end of the IVA must be declared and may be claimed by the Supervisor for the benefit of your creditors.

affect on credit score

Your credit rating will be affected during the course of your IVA for a period of 6 years beginning with the commencement of your IVA.

restricted spending

To ensure your creditors receive a fair payment against the amount owed, your spending will be restricted during the course of your IVA.

debts not included remain outstanding

Any debts not included in your IVA will remain outstanding.

we’ve helped over

1,000 people

find debt freedom

customer feedback

how to get an IVA

1. get advice

Speak to one of our friendly advisors and we’ll assess your situation.

2. figure out your options

Your advisor will discuss which solution is best for you.

3. make a plan

We’ll work out a plan and ensure you’re comfortable with it before speaking to your lenders.

4. start your journey

If your plan is agreed, your loan will be set up and you can start your journey to debt freedom.

FAQs

Fees for an IVA are inevitable, although they can differ significantly among different service providers. Certain companies may only charge fees if your IVA is approved by your creditors. These fees are typically deducted from your regular, manageable IVA payments rather than being added on separately.

An individual voluntary arrangement (IVA) is a formal agreement that you and your creditors must stick to, legally. If you don’t keep up with the payments as agreed, your IVA could fail, leaving you still responsible for your debts. In that case, your creditors could take action against you to recover what you owe. But don’t worry, we’ll only recommend an IVA if it’s the best choice for you based on your situation.

Yes, an IVA is a legally binding agreement between you and your creditors. This means it’s approved by the court, and both you and your creditors must stick to it or there could be serious consequences.

There’s no restriction on taking a holiday while you’re in an individual voluntary arrangement. You’re free to spend your money as you wish, provided you prioritise covering your living expenses and IVA payments first.

Your IVA will remain on your credit file for six years starting from the day it was agreed upon. Once this period ends, you essentially have to rebuild your credit rating from scratch. While this may take some time, there are actions you can take to expedite the process.

One strategy is to apply for small amounts of credit from specialised lending companies catering to individuals aiming to rebuild their credit score. By managing this responsibly — ensuring you repay your borrowing each month — you demonstrate to other potential lenders that you’re a low-risk customer, thereby enhancing your credit rating.

Additionally, you can enhance your credit rating by ensuring you’re registered on the electoral roll and regularly checking your credit file to confirm that all information is accurate.

IVAs are more likely to get the green light when you’re paying as much as you reasonably can without putting yourself in financial distress. Your proposal will make this clear by detailing your income and expenses. Including all your creditors also improves the chances of acceptance, ensuring fairness for everyone involved.

Rest assured, the qualified IVA experts we work with will only present your proposal to creditors if they believe it has a good chance of being accepted. Ultimately, it’s up to your creditors to decide by voting on the proposal. For it to be approved, creditors representing over 75% of your debts need to vote ‘yes’.

Owning a home and having a mortgage doesn’t prevent you from pursuing an IVA. If there is more than £5,000 of equity in your home, you’ll usually have to remortgage to release money to be paid into your IVA. Equity is how much money you’d make from selling your home once any mortgages were paid off. If you’re unable to remortgage, you’ll carry on making your IVA payments for up to another 12 months. This means your individual voluntary arrangement will last up to six years instead of five.

success stories

We’ve helped thousands of people with their debt and money worries. But don’t just take our word for it.

claire’s story

read claire’s storywhy choose us:

over 1,000 people out of debt

With a proven track record, there’s nothing we haven’t come across before. We don’t judge, just listen and help.

free help and advice

Talking to our advisors is free and secure. Our staff our friendly and are here to help.

online help service

If you don’t fancy speaking to our friendly assistants over the phone, we have an online service to calm any worries you might have.

Visit Money Helper, to help you manage your money and for further advice.

free find debt freedom guide

Our free find debt freedom guide is here to help you establish your money issues and how best to start solving them.

get help with your unsecured debt

We help you manage debts with some of the UK’s biggest creditors.

customer feedback